Goexch9 Review: Features, Security, and How Vlbook Enhances Your Trading Experience

In the rapidly evolving world of cryptocurrency exchanges, Goexch9 has emerged as a platform that blends user‑friendly design with advanced trading tools. Whether you are a seasoned trader or just stepping into the digital asset arena, this article provides a detailed look at what sets Goexch9 apart, its core features, security protocols, and how the integration of Vlbook can further enhance your trading strategy.

Key Features of Goexch9

- Multi‑Asset Support: Goexch9 offers a wide range of cryptocurrencies, from mainstream coins like Bitcoin and Ethereum to emerging altcoins, giving traders ample opportunities for diversification.

- Advanced Order Types: Market, limit, stop‑loss, and trailing orders are available, allowing precise control over entry and exit points.

- Intuitive Dashboard: The platform’s UI is designed for quick navigation, with customizable widgets that display real‑time price charts, order books, and trade history.

- Liquidity Pools: Goexch9 partners with multiple liquidity providers, ensuring tight spreads and minimal slippage during high‑volume periods.

- API Access: Professional traders can integrate their own algorithms through robust REST and WebSocket APIs.

Security Measures That Build Trust

Security remains a top priority for any exchange. Goexch9 implements a layered defense strategy:

- Cold Storage: Over 95% of user funds are stored offline in geographically distributed cold wallets, reducing exposure to hacks.

- Two‑Factor Authentication (2FA): Users must enable 2FA via authenticator apps or SMS, adding an extra verification step during login and withdrawal.

- Withdrawal Whitelists: Funds can only be sent to pre‑approved addresses, mitigating unauthorized transfers.

- Regular Audits: Independent security firms conduct periodic penetration testing and code reviews.

- Insurance Fund: In the event of a breach, a dedicated insurance pool helps reimburse affected users.

How Vlbook Complements Goexch9

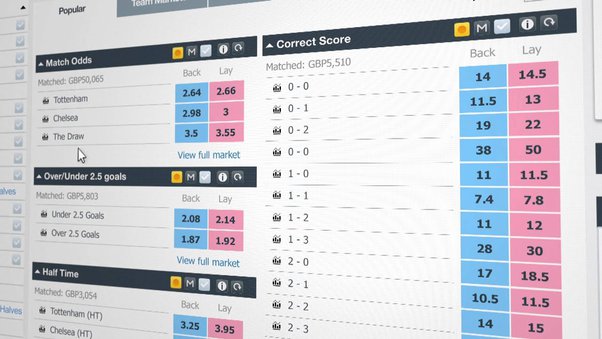

While Goexch9 provides a solid trading environment, many traders seek additional analytics to refine their strategies. This is where Vlbook comes into play. Vlbook is a third‑party analytics suite that aggregates order‑book depth, historical volume, and market sentiment across multiple exchanges, including Goexch9.

Benefits of Using Vlbook with Goexch9

- Deep Order‑Book Insights: Vlbook visualizes hidden liquidity, helping traders anticipate price movements before they occur.

- Cross‑Exchange Comparison: By comparing Goexch9’s order flow with other platforms, users can spot arbitrage opportunities.

- Custom Alerts: Set triggers for sudden volume spikes or price deviations, ensuring you never miss a market shift.

- Historical Data Mining: Access extensive back‑tested data to evaluate the performance of past strategies under varying market conditions.

Integrating Vlbook’s data feeds directly into Goexch9’s charting tools provides a seamless workflow: traders can execute orders on Goexch9 while simultaneously monitoring sophisticated analytics from Vlbook.

Getting Started: A Step‑by‑Step Guide

- Create a Goexch9 Account: Visit the official site, complete the KYC verification, and enable 2FA for added security.

- Fund Your Wallet: Deposit supported cryptocurrencies or fiat through the platform’s payment gateway.

- Link Vlbook: Register on the Vlbook portal, generate an API key, and paste it into Goexch9’s “Analytics Integration” settings.

- Configure Alerts: Use Vlbook’s dashboard to set price or volume alerts that push notifications to your mobile device.

- Execute Trades: With real‑time order‑book depth displayed, place market or limit orders directly from the Goexch9 interface.

Performance and User Experience

Feedback from the crypto community highlights Goexch9’s low latency and reliable order execution. The platform’s server infrastructure is distributed across data centers in Europe, North America, and Asia, ensuring fast order routing regardless of a trader’s location. Coupled with Vlbook’s high‑frequency data updates (sub‑second refresh rates), users enjoy a near‑real‑time trading environment that supports both manual and algorithmic strategies.

Potential Drawbacks and Considerations

While Goexch9 offers a robust suite of features, it is essential to note a few areas where users should exercise caution:

- Limited Fiat On‑Ramps: The platform primarily supports crypto deposits; users seeking direct bank transfers may need a secondary exchange.

- API Rate Limits: High‑frequency traders should monitor API usage to avoid temporary throttling.

- Third‑Party Dependency: Relying on Vlbook means an additional point of failure; ensure you have backup analytics in place.

Conclusion

Overall, Goexch9 positions itself as a competitive option for traders seeking a blend of security, liquidity, and user-friendly design. The partnership with Vlbook elevates the platform’s analytical capabilities, delivering deeper market insights that can translate into more informed trading decisions. By following the simple onboarding steps outlined above, both newcomers and seasoned professionals can harness the combined power of Goexch9’s execution engine and Vlbook’s data intelligence to navigate today’s dynamic cryptocurrency markets with confidence.